We received this invitation in the mail for a “Complimentary Gourmet Meal” and seminar, “Understanding Different Retirement Strategies.”

Much like the free weekend to sell timeshares, the free meal and educational seminar is a common practice among salespeople in the financial industry. The outside of the flier didn’t even say who was hosting, so right off the bat it was obvious they were trying to put the focus on the free food rather than the sales pitch.

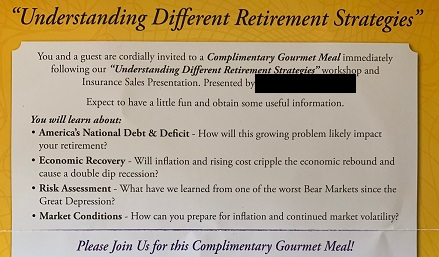

Inside, I saw exactly what I expected, that this would be a “workshop and Insurance Sales Presentation.” At first, I was pleased to see they are at least up front about it being a sales pitch, until I noticed the phrase was capitalized and, being a lawyer, I know such things are usually not an accident. After 20 seconds of Googling, I confirmed my suspicions – this was a required disclosure under the California Insurance Code. Turns out the State of California doesn’t want insurance sales agents misleading the public regarding the true purpose of the dinner. You may be getting a free meal but are being sold so much more.

It is the content of this seminar I want to discuss here, however, because at once I could see this sales pitch is classic fear-mongering sales agents have used for years to drive marks…uh, I mean, clients…into the alleged “safety” of insurance products. No, I didn’t attend the seminar, but I’ve been around enough to know what this is about.

The seminar promises you will learn about:

- America’s National Debt & Deficit – How will this growing problem likely impact your retirement?

Why will the sales agent talk about the debt and deficit? Two words: Social Security. Since the Reagan administration sales agents have played on Social Security insolvency fears to sell life insurance policies. Has the government ever missed a check? Nope, and think about what would happen to the politicians if it did.

But rather than try to convince you Social Security is fine, let me ask what you should do if you are concerned about it’s future? The answer is to save more and invest. If you need to fund more income in retirement, you need a bigger nest egg, and those are the only solutions.

What you shouldn’t do is buy a high commission, low return life insurance product. Sales agents may promise a “guaranteed” return, but won’t tell you the return will be lower than a diversified portfolio, with negative returns for many years, and will lock you in for decades. Investing in a portfolio of stocks and bonds appropriate for your risk tolerance will provide you with a better long-term return and leave you with more money when you retire, which is what matters most and gives you the most options at retirement.

- Economic Recovery – Will inflation and rising cost cripple the economic rebound and cause a double dip recession?

My first question is how long have these sales agents been talking about a “double dip recession?” It’s been a hot topic since the recovery began in 2009 and I bet they’ve been using it in every sales presentation since. Here’s an article from 2011 about the fears of a double dip recession.

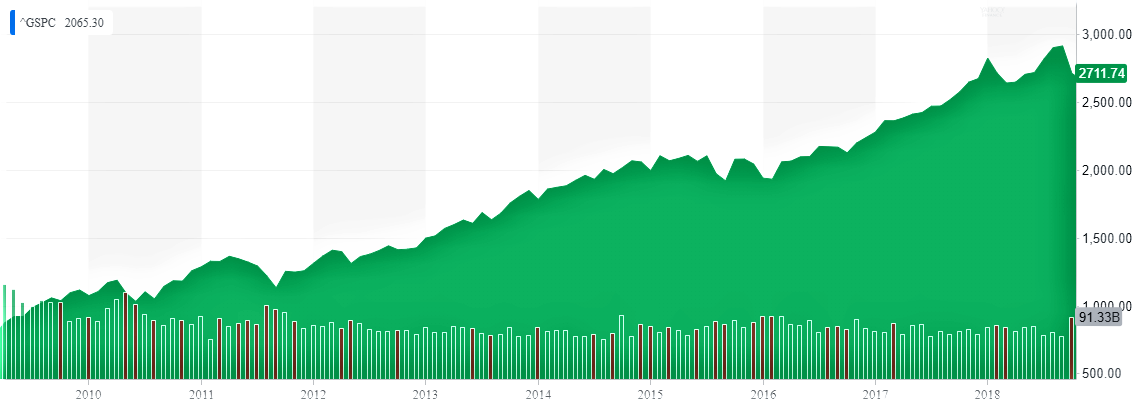

How has the stock market done since 2009? I’ll let the picture tell the story:

Clearly, investing based on fear has not been a good strategy since the Great Recession. If you had locked yourself into a life insurance policy, you would have missed these gains.

Inflation is a concern, and I am watching this as a near-term risk to the economy. But what should you do about it? Again, buying into a high commission, low return life insurance product won’t solve your problem, particularly as inflation eats away the value of your savings. Investing in a portfolio of stocks and bonds appropriate for your risk tolerance will provide you with a better long-term return and leave you with more money when you retire, which is what matters most.

- Risk Assessment – What have we learned from one of the worst Bear Markets since the Great Depression?

What have we learned? Well, we learned that markets can go down. We also learned that markets recover. If you were unfortunate enough to invest at the all-time stock market highs in October 2007, you are ahead today. While holding through this volatility was quite the roller-coaster, with a long time horizon and appropriate risk tolerance (don’t sell at the lows!), investors made money holding through this period.

Some investors can’t handle the ride in the stock market. I get it. The guaranteed return in an insurance policy sounds great to them. OK. But you need to ask yourself a few questions first:

- Am I OK with earning very low returns, perhaps 2-3% annually, for decades?

- Am I OK with NEGATIVE returns for many years?

- Am I OK with being locked-in, unable to change my mind or else face steep surrender fees?

Exiting a life insurance policy early can cost you big bucks in surrender fees, and even holding on for decades provides meager returns. Is it worth it?

A better solution is separate investing from insurance. Get a term insurance policy for your life insurance needs and invest your money elsewhere. If you are looking for conservative investments, there are many to be had – Money markets, CDs, government or investment-grade corporate bonds, bond funds, municipal bonds. You can mix these into a portfolio and add an appropriate amount of stock market exposure if it suits you. There are many ways to structure a conservative portfolio for investors and doing so outside of insurance gives you more flexibility and likely better returns.

- Market Conditions – How can you prepare for inflation and continued market volatility?

Inflation is the enemy of the long-term investor and market volatility is the price of admission. Beware of anyone who tells you there is an easy way to tame these two beasts.

Inflation will erode the purchasing power of your savings unless your rate of return exceeds the inflation rate. Can you achieve this in a high commission, low return life insurance product? I doubt it. Some insurance policies are structured to achieve higher returns, but any investments made within an insurance policy can be made more cheaply, more simply, and with greater flexibility outside of a policy.

There is no way to reduce or avoid market volatility other than to diversify your investments. “Guaranteed” returns are low returns, and will likely leave you with far less at retirement than if you invested in a diversified portfolio. Find an asset allocation that suits your risk tolerance and time horizon and stick with it.

Beware those steak dinners!

Bottom line: Insurance sales agents will entice you with the offer of steak dinners, but they will find your fears, push your buttons and lo and behold, life insurance is the answer! Don’t believe them.

Investing isn’t easy. We’ve all been through tumultuous times as investors, and we are concerned what the future will bring. But it’s a lot harder to achieve your goals if you are paying high fees to earn low returns and are locked into this arrangement for decades. Everything the sales agents claim insurance can do can be done more simply, with more flexibility, and likely better long-term, after-tax returns than through insurance.

Steak dinners are expensive, but they are more expensive when they’re free.