Recent economic data is strong and the stock market recently hit all-time highs. It’s amazing to think that in 2017 some people thought Trump was going to crash the economy and the stock market.

Nobel-Prize winning economist Paul Krugman wrote Trump’s election would cause a global recession.

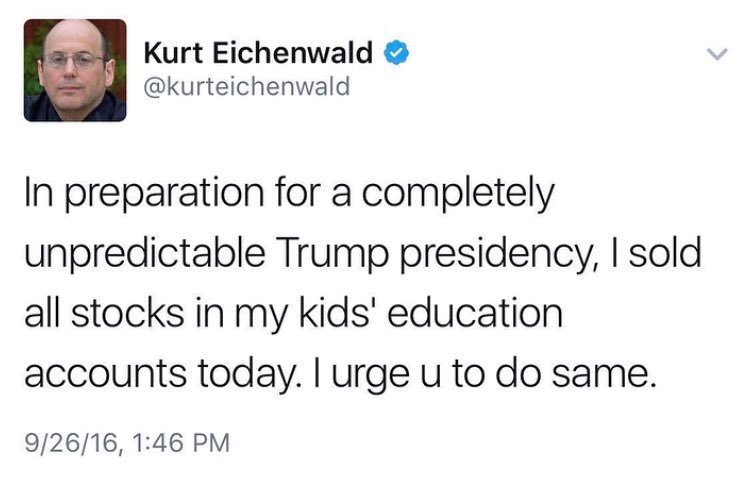

Journalist Kurt Eichenwald famously sold stocks because he thought a Trump election would cause the markets to crash.

Oh you think just the anti-Trumpers make dumb, politically biased statements?

Following President Obama’s election as the economy was crashing in the middle of the Great Recession, Fox News commentators tried to blame him for a plunging stock market. Gretchen Carlson said, “There’s a lot of feeling in the market not reacting very well to the election of Barack Obama,” while Dick Morris claimed the market would “continue to tank” because Obama would raise capital gains taxes. This was just a few months away from the stock market’s bottom.

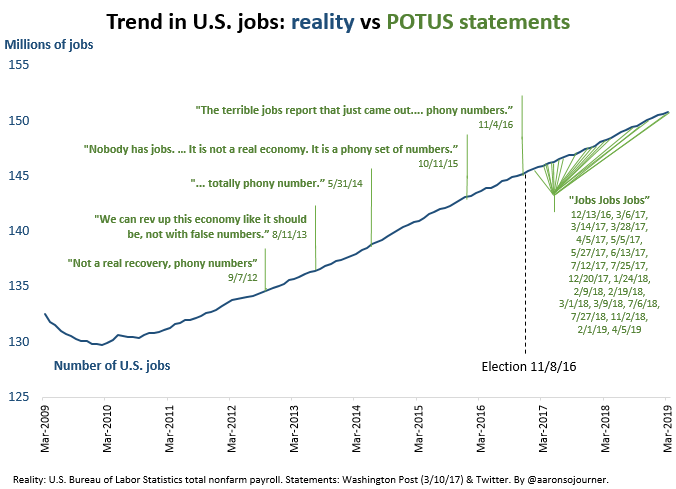

As Obama’s presidency went on, some tried to claim good economic data was “phony” with no better example than the current President himself:

There are many more examples on both sides. Their “analysis” isn’t much more sophisticated than:

- “I don’t like Trump, so economy and markets will crash.”

- “I don’t like Obama, so the economic growth is fake.”

If data comes in that favors their view, they blow it out of proportion. If the data contradicts their view, it’s unimportant or phony.

It’s easy to ridicule these horribly bad opinions, but the idea that someone might listen to these people and invest based on these beliefs is the real concern.

Political Polarization Infects Economic Views

Today, there’s much discussion about giving President Trump credit for the economy and stock market particularly after the latest strong jobs report. Republicans boast about the great economy while Democrats wish to downplay recent economic success or avoid crediting the President. The reverse was true during the Obama era.

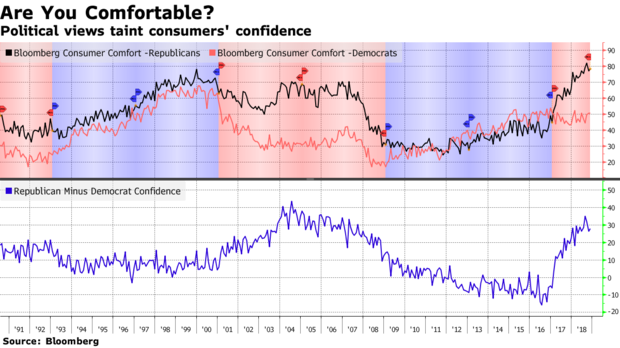

Data on consumer confidence shows this political-economic divide exists not just among the politicians or pundits, but among the public as well. Republican consumer confidence rose slightly during the Obama years, rising much less than Democrats during the same period despite improving conditions. Upon Trump’s election, there was a significant shift between the parties with Republican confidence surging to new highs while Democrats have been fairly stagnant.

Focus on the Fundamentals

I am skeptical of how much economic success (or failure) to attribute to the President. What concerns me, however, is when such partisan political beliefs make their way into someone’s investment portfolio.

Are you making investment decisions based on whether your candidate is in power? If so, you may be missing out on big potential gains or may hold on too long into potential disasters.

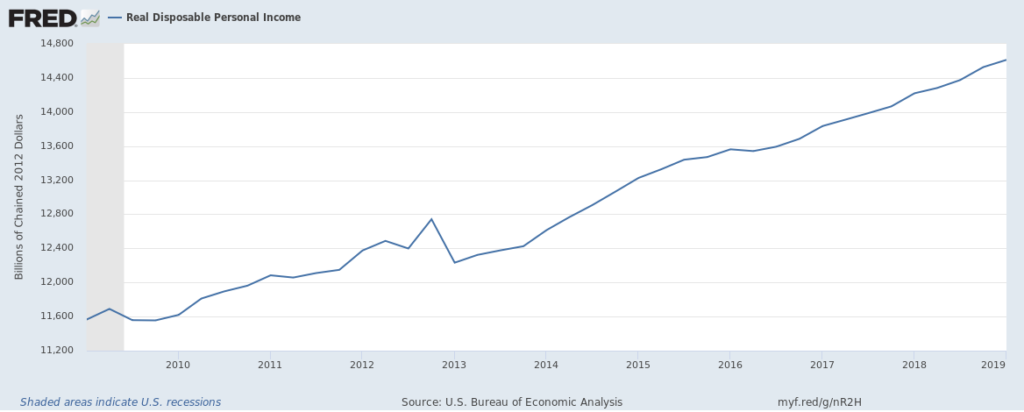

Sure, I see potential investment risks in Trump’s policies, but also saw risks in Obama’s and do see risks in policies of the 2020 Democratic contenders as well. A strong focus on economic fundamentals has kept my head level as political chaos swirls around. Looking back over the last 10 years, what we see is an economy slowly and steadily recovering from the worst recession since the Great Depression.

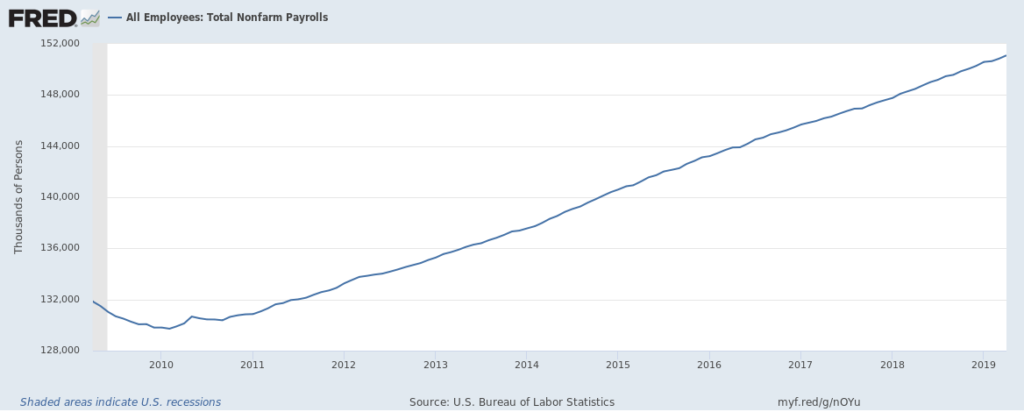

Employment: Up and to the right.

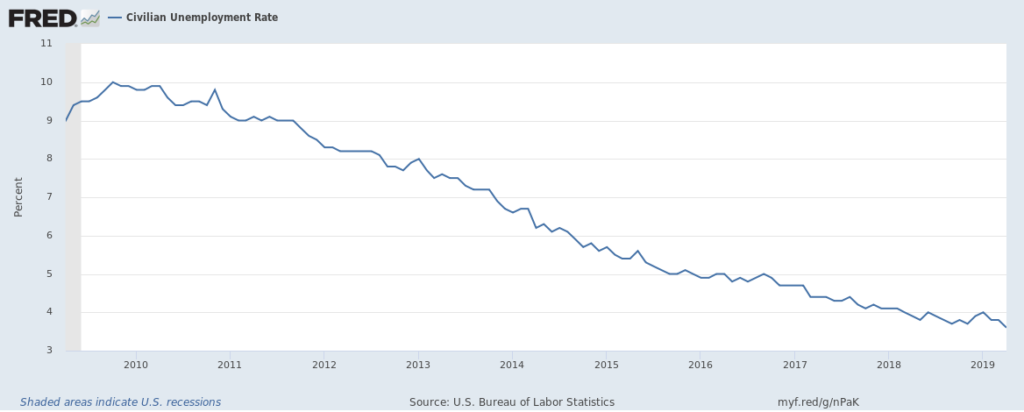

Unemployment rate: Steadily lower.

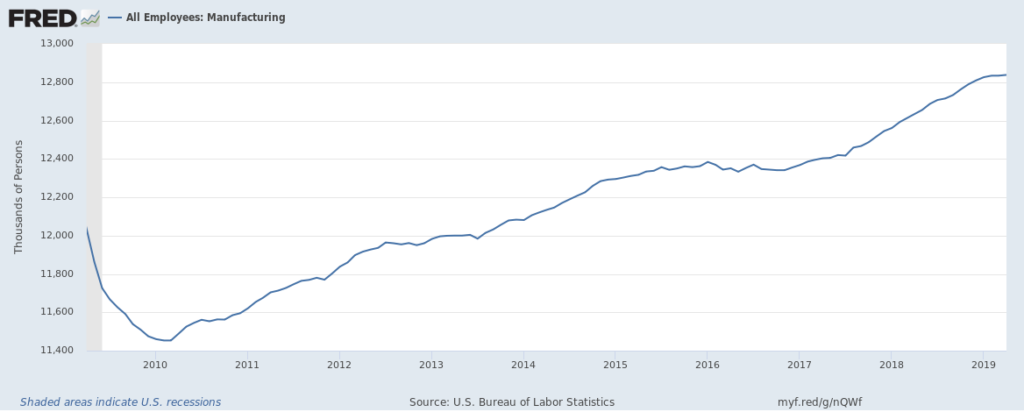

What about manufacturing jobs? Strong and getting stronger.

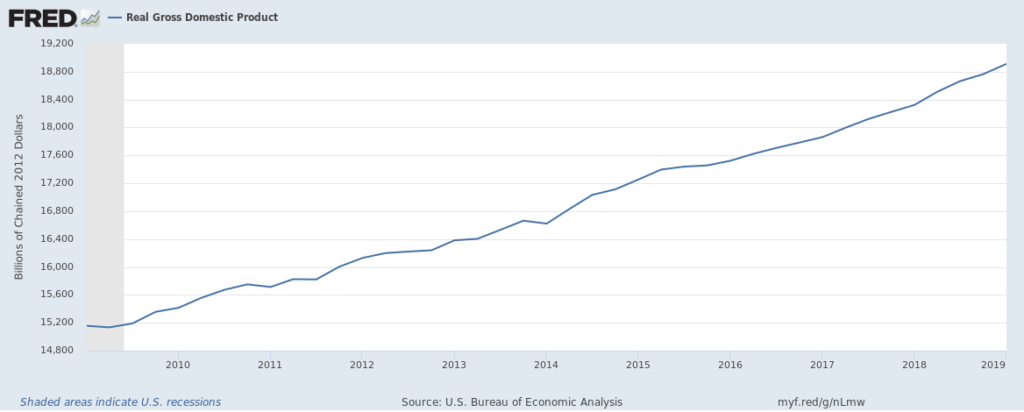

GDP: Growth persists.

Incomes rising.

And the results for stock market investors:

The picture is one of slow but steady recovery since the Great Recession, one that began under Obama and continued under Trump. Obama inherited a terrible economy in the middle of a crash and left with a decent economy. Trump inherited a decent economy and now we have a good one. Some policies of each president helped the recovery along, while others put roadblocks in the way.

Yet despite the chasm between each president’s policies, the overarching trends look nothing like the volatility of the political debate. How much credit you want to give to each president is a political not an investing question, and I suggest your answer be consistent for each one lest your bias affect your investing decisions. The economy has been improving for ten years and, with occasional volatility, the stock market has followed. None of that has anything to do with politics, and if you didn’t buy in because Obama was president, or if you bailed because Trump got elected, you missed out on significant gains.

Of course, risks exist for both the market and the economy, and some of those risks are based on political decisions (as I write this, the market is down this week on trade tensions with China). However, politics is far too overemphasized in our country and it is easy to mix up one’s political opinions with what is happening in the markets and the economy. Investing requires a sober, unbiased view of what is likely to happen, and that is impossible if you confuse it with what you wish to happen.

In our increasingly polarized country, it is becoming more important than ever to check your political biases at the door when investing. A focus on facts and fundamentals will improve your decisions.